Understanding the W-4 Form: An Employer's Withholding Compliance Guide

When you’re hiring, the amount of onboarding paperwork you need to manage can be overwhelming. Even if new employees are primarily responsible for completing necessary documents, like the W-4 form, there are still some steps you’ll need to take to ensure it’s filled out correctly. Are you familiar with all the rules? We’ll break down the requirements here. To help you understand what you and your workers need to do to comply with the W-4 rules, in this article, we’ll explain what the form is used for, who fills it out, how to complete it properly, and recordkeeping requirements. After reading this, you’ll have the insight you need into the W-4 form to maintain compliance.

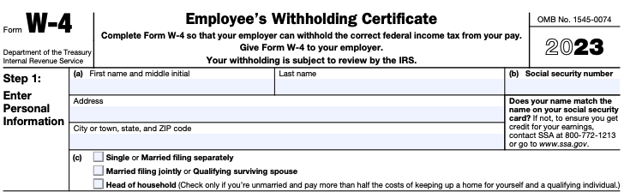

What is the purpose of the W-4 Form?

Form W-4, called an Employee’s Withholding Certificate, is an IRS document that employees must complete to let their employers know how much money to withhold from their paycheck for federal taxes. This amount is based on several factors, including:

- Filing status

- Number of jobs

- Dependents

- Other income

- Anticipated credits and deductions

- Additional withholding desired

The amount an employee authorizes to be withheld then counts towards the annual income tax due at the end of the year. If they overpay their taxes based on the withholdings they indicate on the W-4, they’ll be entitled to a refund. Conversely, if their taxes are underpaid, then they’ll have to pay more to the IRS at tax time and may even risk penalties of between 5% and 25% of the underpaid amount.

In addition to having new hires complete a W-4 form, it should also be filled out when an employee’s personal or financial situation changes, such as when they get married, have a child, or take a second job. To help employees avoid big surprises in April, it’s a good idea to remind them to consider completing a new Form W-4 each year. There’s no limit on the number of times an employee can fill out a new W-4.

Once you receive a new form, you’ll need to begin withholding the revised amounts no later than the first payroll period ending on or after the 30th day after the employee provided it to you.

If an employee doesn’t have any changes to their W-4, then the one on file remains in effect until an employee provides a new one.

What is the Form W-4 employer responsibility?

As an employer, you’re required to provide a W-4 form to each new employee. This can be either a hard copy or you can set up an electronic system for receiving forms from your employees as long as it complies with IRS regulations.

Once an employee has the form, they are responsible for the completion and accuracy of the document, which we’ll discuss next. Be sure to have new employees complete the form as soon as possible but at least before you issue their first paycheck. If the employee doesn’t return a form, then you’ll withhold tax as if they were single, with no withholding allowances.

The only step you as an employer need to take is to enter your name, address, and Employer Identification Number (EIN) at the bottom as well as the first date of the worker’s employment.

Once both you and the employee complete a Form W-4, you don’t need to submit it to the IRS but should keep it for four years. However, in some circumstances, you may need to submit copies for certain employees to ensure they have adequate withholding. The IRS will direct you in writing if you need to submit a form.

If the IRS determines that an employee doesn’t have enough withholding, then it will require you to increase the amount by issuing a “lock-in” letter, which is referred to as Letter 2800C. This letter will specify the maximum number of withholding allowances allowed for the employee.

What steps does the form have?

Employees can be subject to a $500 penalty if they submit a Form W-4 that includes false statements and results in less tax being withheld than is required. So it’s important that they understand how to complete it correctly. For assistance on how to complete the form, you should encourage employees to use the IRS’ Tax Withholding Estimator tool.

To answer additional questions your employees may have, here’s a step-by-step breakdown of what’s required.

Step 1: Enter Personal Information

This section of the form will ask employees for their name, address, Social Security number, and tax filing status.

The next steps 2-4 only need to be completed if the situations apply to the employee.

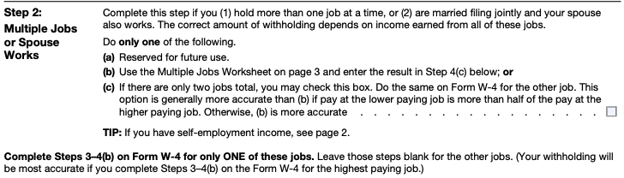

Step 2: Account For Multiple Jobs Or A Working Spouse

Step 2 of the W-4 form is intended for employees who may have more than one job or are married and their spouse is also employed. Depending on the option the employee chooses to determine the appropriate amount to enter here, they may need to reference a Multiple Jobs Worksheet on page three of the form.

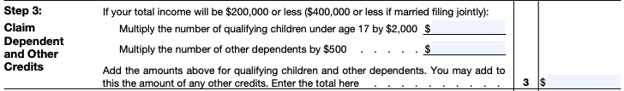

Step 3: Claim Dependents

This section is used to determine any amount of the child tax credits and credit for other dependents an employee may be able to claim when filing their tax return.

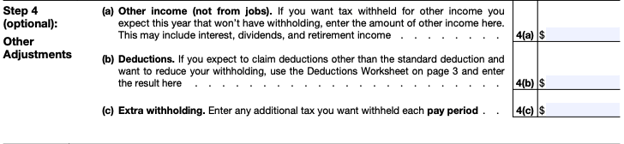

Step 4: Account For Other Adjustments

This optional section is designed to capture other income that’s not subject to withholding, additional withholdings the employee may want to request, and deductions they want to be reflected. For employees who plan to itemize deductions, there’s a worksheet included with the form.

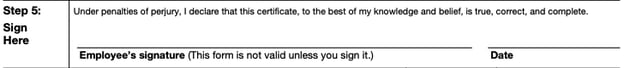

Step 5: Sign

This section should be signed and dated by the employee. Without a signature, the form isn’t valid.

It’s important that you communicate to employees that it’s their responsibility to complete the form correctly. Employers are not liable for an inaccurate or invalid form.

How can I ensure compliance with the W-4 when onboarding?

There’s a lot to think about when you bring on a new employee. One of the most important steps you need to take is ensuring all new hire paperwork is completed correctly and on time, including the W-4 form. Access Form W-4 and other new worker onboarding forms on our resources page.

But there’s much more to staying compliant when onboarding new hires. If you want to ensure you and your employees meet all the requirements while laying the groundwork for a successful start and future success, get started by learning more about how to create a comprehensive onboarding process.

Editors Note: This blog was originally published in January of 2021 and was updated in April of 2023 for accuracy.

in

HR

,

Compliance

,

Hiring

,

Form W-4

HR

,

Compliance

,

Hiring

,

Form W-4