What Are The FLSA Overtime Rules? How Employers Can Stay In Compliance

In recent years, the number of Fair Labor Standards Act (FLSA) claims filed for alleged violations has been on the rise, with more than $230 million in total back wages recovered in 2021.

If you’re like many employers, the FLSA rules for calculating overtime pay can be confusing. Unfortunately, if you don’t understand the requirements of the law, you’re setting yourself up for possible penalties of up to $1,000 for each violation and $2,203 for repeated or willful violations in 2022.

Complete Payroll Solutions’ compliance experts advise clients of all sizes on how to stay compliant with federal and state employment laws and regulations. One of the most common areas of confusion for our clients is correctly paying overtime.

Here, we’ll explain the requirements for overtime pay. After reading this, you’ll know the rules and how to ensure proper recordkeeping to get calculations right. This should help you avoid fines and allegations of improperly paid overtime.

What is the FLSA?

The FLSA is a broad federal law that covers several areas of the employer/employee relationship. While the law contains many elements that employers need to be aware of, one of the areas that warrants special attention is the overtime pay rule.

Are my employees covered by the FLSA?

More than 143 million American workers are protected by the FLSA so the law covers most employees — and likely yours. Specifically, the FLSA covers:

- Employees of any enterprise engaged in interstate commerce

- Employees of any enterprise engaged in the production of goods for interstate commerce; or

- Employees of an enterprise with annual revenues exceeding $500,000

What does FLSA overtime mean?

The FLSA requires that employees be paid at least one and a half times the regular wage rate for all hours worked over 40 in one workweek, which is defined as seven consecutive 24-hour periods.

You’re required to pay overtime during the payroll period in which the employee earned it. If you pay weekly, then it must be paid weekly. If your payroll is bi-weekly, then you’ll pay it bi-weekly, although the amount is still based on a 40-hour workweek.

Who is exempt from FLSA overtime?

You’re not required to pay exempt workers for any hours worked over 40 in a single workweek. While there are several exemptions to the FLSA’s overtime pay requirements, the most common is the white-collar exemption. This exclusion applies to:

- Executive, administrative, and professional employees

- Outside sales employees

- Employees in certain computer-related occupations

- Highly compensated employees

To determine if an employee qualifies for the white-collar exemption, there are three tests, each of which must be satisfied:

- Duties test: The employee’s primary duty must involve the kind of work associated with the exempt status sought

- Salary level test: The employee must be paid a minimum of $684 a week

- Salary basis test: The employee must be paid a predetermined and fixed salary that isn’t subject to reduction based on the quality or quantity of work

How is FLSA overtime calculated?

As we mentioned earlier, the FLSA requires that employees be paid at least one and a half times the regular wage rate for all hours worked over 40 in one workweek.

An employee’s “regular wage rate” generally includes all compensation, with a few exceptions. So things like piece rate or bonus pay are also taken into account. After calculating total compensation, divide it by all the hours worked during the workweek to determine an employee’s regular wage rate.

To determine the hours an employee worked, you need to consider all compensable time, which can even include:

- Unauthorized work time if the employer knows or has reason to know and would benefit from it

- Time an employee is not able to effectively use for their own purposes

- Time an employee spends on preparatory and concluding activities like putting on and taking off gear

- Travel time other than normal commuting to and from work

- Job-related meetings and training

- Other time spent at the employer’s request or discretion

While calculating overtime may seem straightforward, for many employers, it’s anything but. For example, common questions we get from clients include:

Q: What happens if I have employees who work in multiple locations with separate federal IDs. Should I combine their hours for overtime purposes?

A: Yes, the hours need to be combined.

Q: If I pay bi-weekly and one of my employees worked 44 hours in week one but only 20 in week two, are they still owed overtime for four hours?

A: Yes, you would need to pay the employee four hours of overtime.

Q: If an employee volunteers for a shift and works over 40 hours in a week, do I still have to pay them overtime?

A: Yes, you would need to pay overtime for any hours over 40 in a workweek.

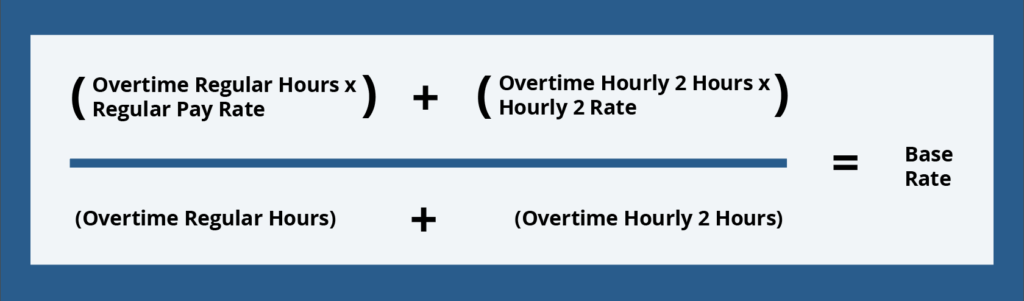

Q: If my employee has two different rates of pay for different jobs they work, how do I calculate the right wage rate for overtime?

A: To determine an overtime rate based on the type of work performed, you need to track the pay rate for each of the overtime hours worked and calculate a blended base pay rate. The formula for blending two hourly rates is:

Are there state overtime laws?

Some states have enacted legislation that differs from what the FLSA requires, such as greater overtime obligations.

Some examples include:

- In California, double pay is required for any hours worked over 12 in a day or in excess of eight hours on any seventh day of a workweek

- In Oregon, overtime pay is required after 10 hours worked in a workday for certain manufacturing environments

- In Alaska, overtime is required if an employee works more than eight hours in a single day

If your employees are subject to both state and federal laws, you’ll need to comply with whichever law has provisions that are more generous to the employee. Be sure to check your state law, which can usually be found on your labor department’s website.

What are the consequences of FLSA overtime violations?

If you’re found to have incorrectly calculated overtime or not paid overtime when it was due, you have to pay back wages for the time worked. If you neglect to pay overtime properly and a complaint is filed with the DOL, you’ll pay damages, penalties, and a fine. You may also face additional damages if you violated state laws. In Massachusetts, for example, you would pay treble (triple) damages.

How can I stay compliant?

Generally, compliance issues arise when a disgruntled employee asks why they’re not getting paid overtime, then files a charge with the DOL. At that point, you’ll get a letter that will either let you know you’ll be audited or that you need to pay the overtime wages due to your employee.

Under the FLSA, you need to have records for each non-exempt worker that include identifying information and data on wages, hours, and other items.

The best way to avoid these situations is with detailed recordkeeping. Under the FLSA, you need to have records for each non-exempt worker that include identifying information and data on wages, hours, and other items. Most of the information you’ll already be maintaining and, for purposes of the FLSA, it doesn’t need to be kept in any particular form or separately. Be sure to keep payroll records for at least three years and those on which wage computations are based for two.

Failure to maintain accurate records will make it very difficult to prove compliance with the law so it is important to follow these requirements. It’s important to note that states may have additional recordkeeping laws, so you’ll want to make sure you’re in compliance with those as well.

In addition to recordkeeping, there are other ways you can minimize your risk of FLSA violations.

- Display an official poster outlining the provisions of the FLSA in a conspicuous place in all of your establishments. The poster can be downloaded directly from the DOL website.

- Conduct periodic internal audits. During these audits, review the job descriptions (not just the titles), the hours worked, and payroll records for each employee to make sure they are still classified correctly and afforded the right protections since a determination made upon hiring may change over time. If you decide to make any changes, for instance, shifting an employee to exempt status, you will need to clearly communicate that to the affected employee.

- Train managers, supervisors, and employees on what the law requires since these are often the individuals making decisions that affect an employee and their FLSA rights.

- Be proactive. If an internal audit reveals an issue, be proactive by addressing it promptly, identifying whether it was an isolated incident, and putting policies in place to prevent future problems.

How Can I Comply with the FLSA Overtime Requirements?

With the DOL cracking down on labor law violations, it’s critical to take steps to avoid enforcement action. Complete Payroll Solutions’ compliance experts can help you stay fine-free by assisting with your employee classifications to make sure you’re meeting the FLSA’s overtime requirements. One of the most important things to staying compliant is having a clear understanding of which employees are exempt. Our guide on exempt vs non-exempt employees will help you correctly identify who’s due overtime pay.

in

HR

,

Compliance

,

FLSA

HR

,

Compliance

,

FLSA