What Is A W-2 Form? Facts, Figures, & Filing Deadlines For Employers

Between reporting requirements and payments, tax season can be overwhelming for employers. And one of the first things your company will need to worry about each year is distributing Form W-2 to workers. Just what is a W-2 form and what does your company need to know about it to stay compliant? Let’s find out.

In this article, we’ll explain what a W-2 form is, your company’s responsibilities for providing it to your employees, and the consequences for failing to follow the reporting rules. After reading this, you’ll understand the steps your company needs to take to avoid steep fines.

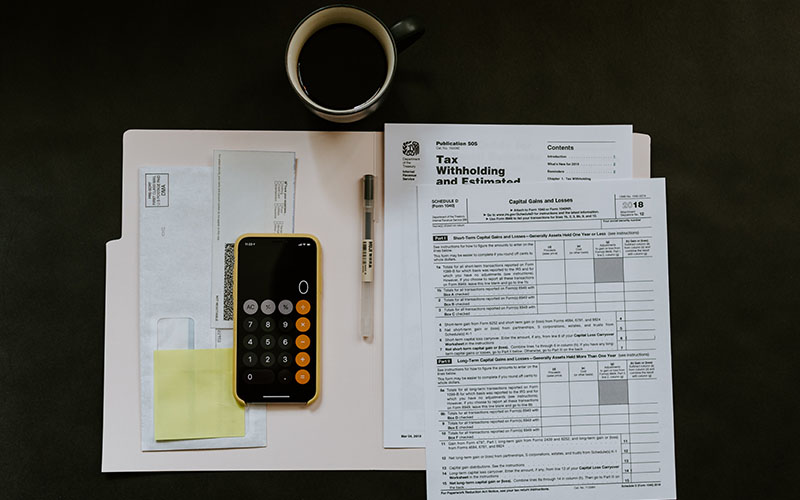

What is Form W-2?

A W-2 form is the IRS’ Wage and Tax Statement that ensures that both employee and employer taxes have been recorded and filed properly.

The form lists an employee’s wages for the year, which includes their wages, tips, and any other compensation like bonuses or commissions for both salaried and hourly workers.

It also shows the amounts withheld from an employee’s pay for federal income taxes based on how they filled out their W-4 Form and any respective state income tax documentation, if applicable. The worker’s share of Social Security and Medicare taxes that was withheld from their pay is also reported. In some states like Rhode Island, there may also be taxes withheld for disability insurance, which would be on the form as well.

Beyond wages and withholdings, Form W-2 also shows benefits information. If your company paid for child care benefits for your employees, that would go in Box 10. In Box 12, the Form W-2 will allocate other benefits with the applicable IRS codes such as:

- Contributions your company made to a worker’s health savings account (HSA)

- Your company’s cost of providing group term life insurance

- Your company’s share of the employee’s health insurance premiums paid if you have 250 or more employees (employers with less than 250 employees are encouraged to provide this information as well)

- Deductions from the employee’s pay for their contributions to a 401(k)

In addition, there are several boxes on the form for basic employer and employee information:

- Employee’s Social Security number, which can now be shortened to the last 4 digits

- Employer Identification Number

- Employer’s name, address and ZIP code

- Control number (optional)

- Employee’s first name and initial and last name

- Employee’s address and ZIP code

When are W-2s due?

As an employer, you’ll need to complete a Form W-2 for each employee and file a copy with the Social Security Administration (SSA) by January 31 each year. However, in years when January 31 falls on a weekend, the deadline is the next business day. If your company ever needs to request a 30-day extension, you can do so by submitting Form 8809.

To submit your company’s forms to the SSA, you will use the transmittal Form W-3. You have the option to submit the W-2s and W-3 by mail or electronically using an authorized IRS e-file provider.

If your company is submitting 250 or more Forms W-2, you must file electronically unless the IRS grants you a waiver. While the Taxpayer First Act of 2019 reduced the threshold for mandatory electronic filing to 100 returns, final regulations have not yet been issued so the number remains at 250 currently.

In some cases, your company may also need to submit a copy of each Form W-2 to your state tax authority. For example, in Massachusetts, filing W-2s is required but the forms don’t have to be filed in others like Florida, which doesn’t levy personal income tax. You’ll want to check with your department of revenue to understand your state’s W-2 filing requirement because some have state-specific forms or procedures.

In addition, if your company is in a state with local income taxes, you’ll be required to submit a copy of Form W-2 to each locality where municipal tax was withheld during the year.

Do I have to provide a W-2 to each worker?

In addition to filing your forms, your company will need to provide a Form W-2 to each worker. The filing deadlines we just discussed are the same dates by which you need to provide the forms to employees in order to give them enough time to complete their taxes. They’ll use the W-2 to enter the amounts reported on both their federal and state tax returns.

Workers will receive 3 copies of the W-2:

- For submitting with their tax return

- To keep in their records

- In case they need to provide it to their state tax authority

It’s a good idea to let employees know when they can expect their forms. If your company is distributing them electronically, you’ll want to make sure you tell employees that as well so they don’t miss their form.

Since employees may no longer work for you when you issue your W-2s, you’ll want to make sure you have an accurate mailing address on file for them. If your company sends an employee their W-2 form and it gets returned to you, you should simply keep it in your records.

What are W-2 penalties?

It’s important to make sure your company meets all the W-2 employer responsibilities or you risk potential penalties. The most common issues employers face when it comes to W-2s are submitting the forms late, failing to include all required information, or including incorrect information.

If your company does any of these things and can’t show reasonable cause, you may face a penalty depending on when a correct form is eventually filed, which varies based on your size.

- Small Businesses: If you’re a small business, meaning one with average gross receipts of $5 million or less over the past 3 years, you can be fined:

- $50 per form filed up to 30 days late, up to a maximum of $206,000

- $110 per form if you file them after 30 days but before August 1, up to a maximum of $588,500

- $290 per form for submissions made on or after August 1 or not at all, up to a maximum of $1,177,500

- Large Businesses: Companies with gross receipts over $5 million in the last 3 taxable years can face the following penalties:

- $50 per form filed up to 30 days late up to a maximum of $588,500

- $110 per form filed 31 days late through August 1, up to a maximum of $1,766,000

- $290 per form for those filed on or after August 1, or not at all, up to a maximum of $3,532,500

If your company realizes you’ve submitted a form with errors, you can file a corrected version. However, if your error relates only to an incorrect dollar amount that doesn’t differ from the accurate amount by more than $100, then you fall under a safe harbor exception and don’t need to file a corrected form or face a penalty.

How can I stay compliant with W-2 employer responsibilities?

With the risk of costly fines for late, incomplete, or inaccurate W-2s, it’s important to make sure your company meets all your employer responsibilities for these forms. Since there’s a lot to keep track of when it comes to Form W-2, your company may want to consider using an online filing service to help alleviate some of the worry that comes with managing your own W-2s. Alternatively, many businesses opt to use a third party payroll provider to handle the forms. To learn what payroll providers do, read our next article on payroll outsourcing. If you decide an outsourced payroll provider is the best approach for your business, read our article on the top considerations when evaluating vendors.

Editor's Note: This blog was originally published in February of 2021 and was updated in January of 2023 for accuracy and to be more comprehensive.